[ad_1]

In spite of a blended bag of earnings experiences from tech organizations lately, a drop in gross domestic solution this earlier quarter and climbing inflation, the cloud continues its relentless enlargement on the information technological innovation landscape.

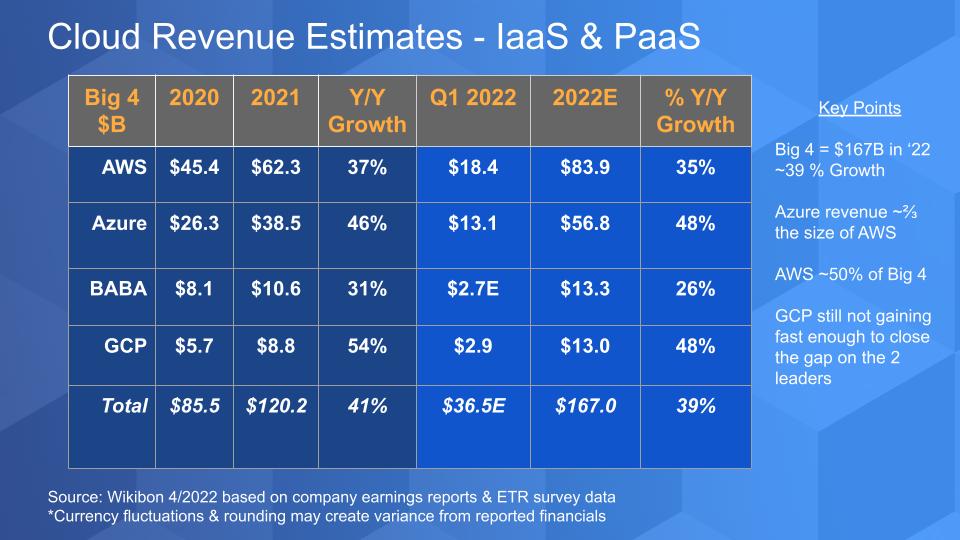

Amazon Website Services Inc., Microsoft Corp. and Alphabet Inc. have all documented earnings and, when you involve Alibaba Group Holding Ltd.’s cloud in the blend, the major four hyperscalers are on observe to deliver $167 billion in profits this yr based on our projections.

But as we have claimed several moments, the definition of cloud is growing. And hybrid environments are turning out to be the norm at main companies. We’re looking at the biggest enterprise tech businesses emphasis on solving for hybrid and every public cloud enterprise now has a technique to convey their environments closer to the place customers’ workloads stay – in information facilities and the edge.

In this Breaking Assessment, we’ll update you on our newest cloud projections and outlook. We’ll share the most recent Business Technological innovation Research details and some commentary on what is happening in the “hybrid zone” of cloud.

Big 4 hyperscale IaaS and PaaS effectiveness

In the chart higher than we share our huge four cloud shares for infrastructure as a provider and platform as a assistance for 2020, 2021, Q1 2022, our estimate for full-yr 2022 and relative progress. Don’t forget, only AWS and Alibaba report relatively clean IaaS and PaaS figures, whilst Microsoft and Google bundle their cloud infrastructure in with their computer software as a services numbers. The two companies, even so, give direction and we use study details and other tidbits to develop an apples-to-apples comparison.

For the quarter, the significant four approached $37 billion in profits as a group. Azure’s progress rate is noted by Microsoft, but the absolute profits quantity is not. Azure progress accelerated sequentially by 49% to just more than $13 billion in the quarter by our estimates, though AWS’ development moderated sequentially but income however hit $18.4 billion. Azure is more than two-thirds the sizing of AWS’ cloud enterprise. Google Cloud System and Alibaba are preventing for the bronze medal but very well behind the two leaders. Microsoft’s Azure acceleration is quite exceptional for this kind of a substantial profits foundation, but it is not unprecedented as we have found this sample just before with AWS. Nonetheless, the simple fact that Azure is growing at the same fee as GCP is pretty impressive.

A few other tidbits: Amazon stock received hammered the working day following it declared earnings mainly because of inflation and slowing development premiums. But AWS proceeds to beat Wall Street’s anticipations. A look at Amazon’s running profits this quarter tells the story. Amazon overall experienced an working decline of $3.66 billion. AWS’ working cash flow was $6.52 billion. AWS’ working margin grew sequentially from approximately 30% to 35.3% – an astoundingly financially rewarding determine. This is comparable to remarkably successful corporations these types of as Oracle Corp. and Microsoft — software package businesses with computer software marginal economics. Is that degree sustainable? Most likely not, but it’s eye-opening however.

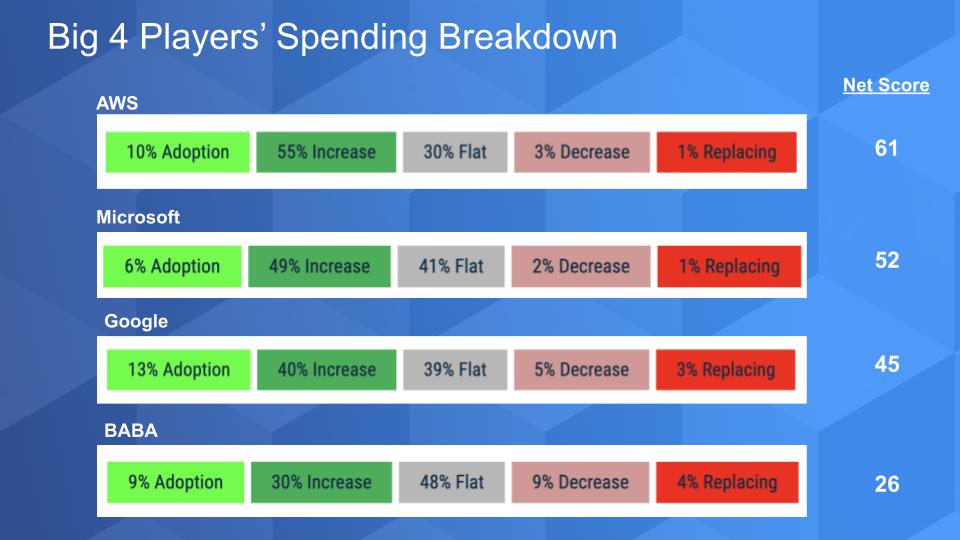

Breaking down the investing styles on the significant 4

The chart over displays the Internet Rating granularity for the big 4 cloud gamers. Internet Score steps shelling out momentum by inquiring buyers if they are adopting new – that’s the lime green growing invest by 6% or much more – that’s the forest green flat invest is the gray spend dropping by 6% or worse – that is the light pink and the purple is decommissioning the platform. Subtract the reds from the greens and you get a Net Score shown on the suitable. Anything at all around 40% is extremely elevated.

The crucial details in this article are as follows: The Microsoft information previously mentioned contains the company’s complete organization – not just cloud. Its Azure-only Net Rating is 67 — better than even AWS’. Which is huge. Google Cloud, on the other hand, when however elevated, is well driving the two leaders. Alibaba’s information sample in the ETR study is modest and China has experienced its foot on the neck of large tech for a although, so we can’t read through too considerably into a Internet Rating of 26.

But detect the replacements in purple – single digits for all and lower solitary digits for the two giants – 1% – really spectacular.

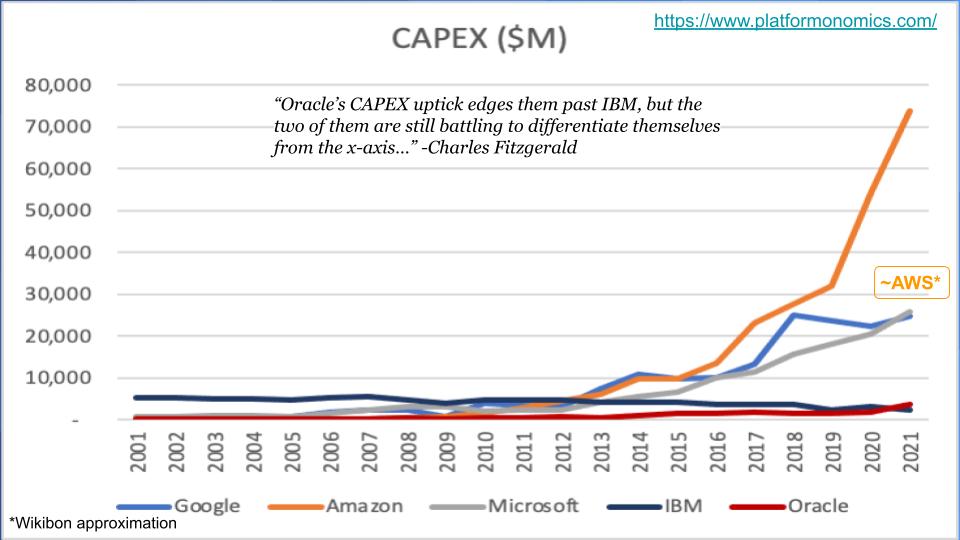

Capital spending tells the story

Capex devote tends to be a pretty excellent indicator of scale. Charles Fitzgerald, who runs the Plaformonomics weblog, spends a lot of time on this subject and we borrowed the chart under from a latest write-up – and added some estimates of our possess.

It reveals Capex shell out above time for 5 cloud companies – the major three U.S. corporations moreover IBM Corp. and Oracle. It is usually astounding to go back to the pre-cloud era and glimpse at IBM. The business was in a excellent position to dominate the transition to as-a-services but couldn’t get its head all around cloud and out of its qualified providers and outsourcing corporations. IBM is that dim blue or black line. It was outspending Amazon in Capex very well into the last ten years. Very same with R&D commit, by the way.

Charles is a little bit of a snark – he loves to make entertaining of our supercloud thought even while we’re self-assured it is evolving and is actual. But his level previously mentioned is appropriate on. The big three U.S. players invest considerably a lot more on Capex than IBM and Oracle. He jokes that Oracle’s uptick in Capex invest places it past IBM, but the two of them are battling to distance by themselves from the X axis. Amusing dude.

In its current earnings report, Amazon stated that about 40% of its Capex goes to infrastructure and most of that to AWS. It expects Capex to increase this calendar year and around 50% will go towards infrastructure, so we’ve superimposed our estimate of where AWS lands.

After all over again Microsoft is noteworthy because as opposed to Amazon, it doesn’t have a zillion warehouses to ship items to people. And even though Google’s investing is large, it’s mostly on servers to power its advert community. Of class, GCP can leverage that infrastructure and the tech at the rear of it. And it does.

And so can anyone else leverage all this Capex devote. We’ll come back again to that and chat about supercloud in a instant.

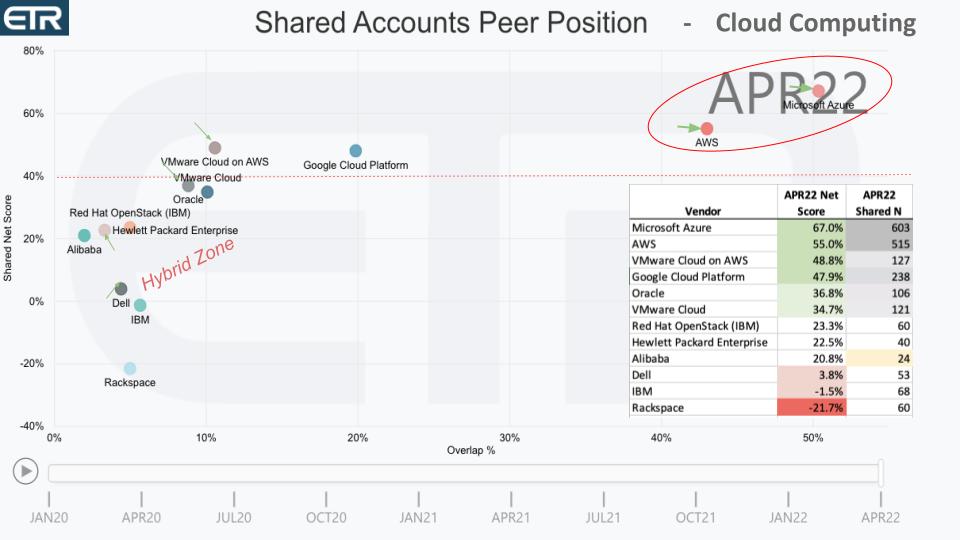

The at any time-growing cloud landscape

The chart higher than exhibits a two-dimensional view of the ETR data for cloud computing. On the vertical axis is Internet Rating or spending momentum and on the horizontal axis is pervasiveness in the knowledge established. The X axis is like market share in the study, if you will. The desk insert displays the knowledge for how the dots for each and every seller are plotted on every single axis.

The crimson dotted line at 40% signifies a extremely elevated position. And the inexperienced arrows demonstrate the motion for some providers relative to 3 months ago.

Microsoft and AWS are circled in purple way up in the right hand corner. Very remarkable. Just to lower clutter, we’re not showing AWS Lambda and some other extremely elevated expert services that would thrust up AWS’ Internet Rating. But it is still actually actually good… as is Azure’s. They’re both equally moving solidly to the correct relative to past quarter’s survey.

Google is effectively driving and has much work to do. It was introduced this previous 7 days that the head of product sales at Google Cloud, Rob Enslin, is leaving to sign up for UiPath Inc… some interesting information there.

We’ve highlighted the “Hybrid Zone.” Now to the theme of this Breaking Evaluation – the at any time-expanding cloud. AWS announced that it has done the launch of 16 nearby zones in the U.S. and there are 32 additional coming throughout 26 countries. Local Zones essentially deliver cloud infrastructure to locations wherever there’s a great deal of IT that isn’t going to move. And for proximity and latency motives, they have to shift nearer to the customers. There is that Capex buildout coming into engage in again.

Now the explanation this hybrid zone results in being exciting is you are viewing the large enterprise gamers at last heading following the hybrid cloud in earnest. It’s practically like the AWS Outposts announcement in 2018 was a wakeup get in touch with to traditional infrastructure players these types of as Dell Technologies Inc., Hewlett Packard Enterprise Co. and IBM. Oracle is sort of skipping to its have tune, but it’s in that hybrid zone also. IBM had a good quarter and the Pink Hat acquisition would seem to be performing to aid its hybrid cloud approach.

VMware Inc. several a long time ago cleaned up its fuzzy cloud method and partnered up with every person. And you see previously mentioned, VMware Cloud on AWS carrying out effectively, as is VMware Cloud, its on-premises featuring. Even while it’s relatively reduce on the X-axis relative to final quarter, it’s going to the suitable with a increased existence in the knowledge set.

Dell and HPE are also appealing. Equally businesses are going tough following as-a-support with APEX and GreenLake, respectively. HPE, centered on the survey information from ETR, appears to be to have a direct in expending momentum, even though Dell has a bigger presence in the study as a a lot bigger organization. HPE is climbing up on the X axis, as is Dell, although not as immediately.

And the issue we arrive back to often is that the definition of cloud is in the eye of the client. AWS can say, “That’s not cloud.” And the on-prem group can say, “We have cloud way too!” It seriously doesn’t matter. What matters is what the customer thinks and in which platforms they select to commit.

Which is why we maintain circling back to the idea of supercloud. You are looking at it evolve and you are going to hear a lot more and additional about it. Perhaps not the expression – lots of never like it – but we’ll carry on to use it as a metaphor for a layer that leverages the Capex reward the significant hyperscalers are furnishing the marketplace. This is a authentic chance for the likes of Dell, HPE, IBM, Cisco Units Inc. and dozens of other providers offering compute and storage infrastructure, networking, security, databases and other elements of the stack. It is different to us than multicloud, which is definitely multivendor– that is, my stack operates on clouds 1, 2 and 3 as a bespoke company.

The possibility in our perspective is to disguise the underlying complexity of the cloud, dealing with all the software programming interface and primitive muck, creating a singular practical experience throughout on-prem, across all the clouds and out to the edge. We see this as a new fight shaping up and new opportunities for startups to aid. It will be highly-priced to build and will demand ecosystem cooperation across the API financial state to make it a reality. There is a definite shopper have to have for this typical expertise and in our perspective we’re observing it manifest in pockets currently and in R&D jobs in just equally startups and established players.

In our look at, it’s the foreseeable future of cloud for any corporation that just cannot invest $30 billion a 12 months on Capex.

Preserve in touch

Many thanks to Stephanie Chan, who researched topics for this Breaking Analysis. Alex Myerson is on output, the podcasts and media workflows. Special thanks to Kristen Martin and Cheryl Knight, who assist us maintain our group educated and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish just about every week on Wikibon and SiliconANGLE. These episodes are all readily available as podcasts wherever you listen.

Email [email protected], DM @dvellante on Twitter and remark on our LinkedIn posts.

Also, check out this ETR Tutorial we made, which clarifies the spending methodology in a lot more detail. Note: ETR is a independent organization from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s info, or inquire about its services, make sure you speak to ETR at [email protected].

Here’s the whole video investigation:

All statements designed regarding businesses or securities are strictly beliefs, points of view and viewpoints held by SiliconANGLE media, Company Technological know-how Investigate, other visitors on theCUBE and visitor writers. These types of statements are not recommendations by these folks to acquire, promote or keep any protection. The written content introduced does not constitute expense assistance and ought to not be applied as the basis for any financial investment decision. You and only you are liable for your financial investment conclusions.

Picture: jijomathai/Adobe Stock

Exhibit your assistance for our mission by becoming a member of our Cube Club and Dice Party Local community of authorities. Join the local community that contains Amazon Net Solutions and Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger and numerous additional luminaries and gurus.

[ad_2]

Source link

More Stories

Internet Explorer Crashes – Stop Internet Explorer Crashing in Minutes

Jobs for Felons in Information Technology – Find Out If You Are a Fit for These Felon Friendly Jobs

Advantages of Information Technology