The raising adoption of digital innovations in the money system is pushing the educational dialogue about its opportunity benefits or negatives to search for a strong foundation of empirical proof. Though prior research have investigated the consequences of details technology (IT) adoption on various banking outcomes (e.g. Beccalli 2007, Koetter and Noth 2013), findings so considerably have been inconclusive and, aside from a several exceptions (Pierri and Timmer 2020, Kwan et al. 2021), have not yet been tested throughout durations of disaster.

In our new paper (Branzoli et al. 2021), we exploit the Covid-19 pandemic – an unpredictable event that is possible to have improved the worth of digital prowess as a source of competitive gain – to analyse versions in credit throughout Italian financial institutions related with various ex-ante concentrations of IT adoption. We locate that IT-intense banks greater their lending to non-money businesses (NFCs) additional than other individuals in the months adhering to the outbreak of the pandemic the improve was economically sizable even when nationwide mobility restrictions were being lifted and public overall health conditions enhanced.

Measuring banks’ IT adoption

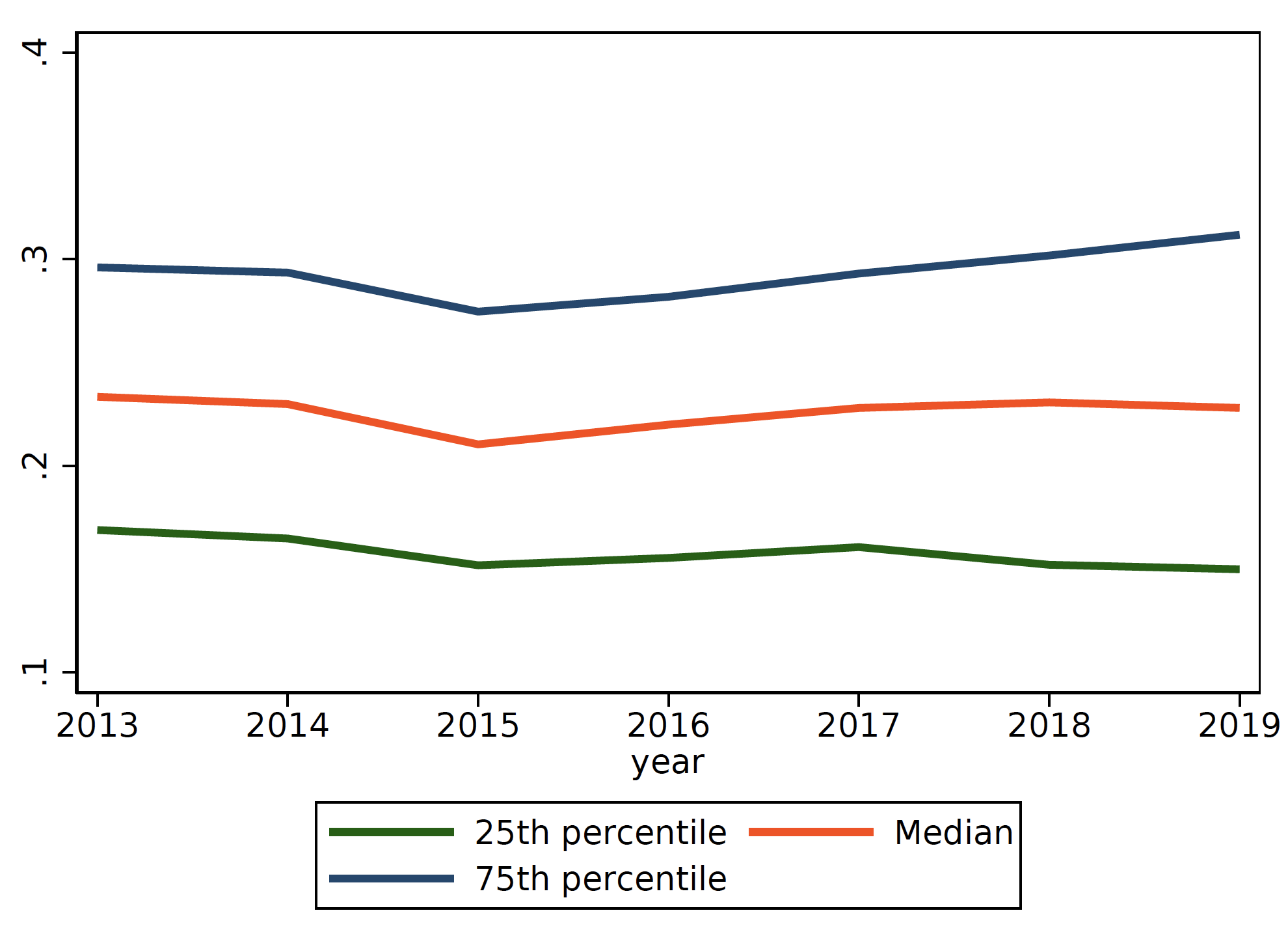

We measure banks’ stage of IT adoption utilizing distinctive data on IT-relevant expenses noted in the revenue statement and survey info on the use of digital systems at the lender stage. These are charges incurred for the order of components (e.g. particular desktops, servers, mainframes) or software, the payment of IT specialists (e.g. pc aid engineers) and the outsourcing of IT solutions to external companies. IT prices are normalised by the whole running prices of the bank. Figure 1, Panel A, reveals the evolution of the IT-to-total expenses ratio over time and across percentiles.

To evaluate regardless of whether a higher share of IT charges is associated to a greater diploma of IT adoption, we explore the partnership involving banks’ IT expenditures and the use of electronic technologies. We incorporate knowledge on IT expenditures with financial institution-stage study data on the standing of electronic transformation of the Italian banking sector.1 More specifically, we request banking companies to suggest which fiscal services they offer you on-line (e.g. financial loans, payments, asset management), if any. Respondents are also requested no matter if they have innovative projects under way, which technologies underlines them (e.g. big data, biometrics, artificial intelligence) and for what function (for instance, improving client profiling or credit chance analysis). Managing for a loaded set of financial institution features (like measurement, funding framework, and profitability), we obtain that our evaluate of IT adoption is basically linked to banks’ degree of digitalisation and propensity to innovate: the better the IT expenses, the better the probability of providing digital solutions and partaking in progressive processes.

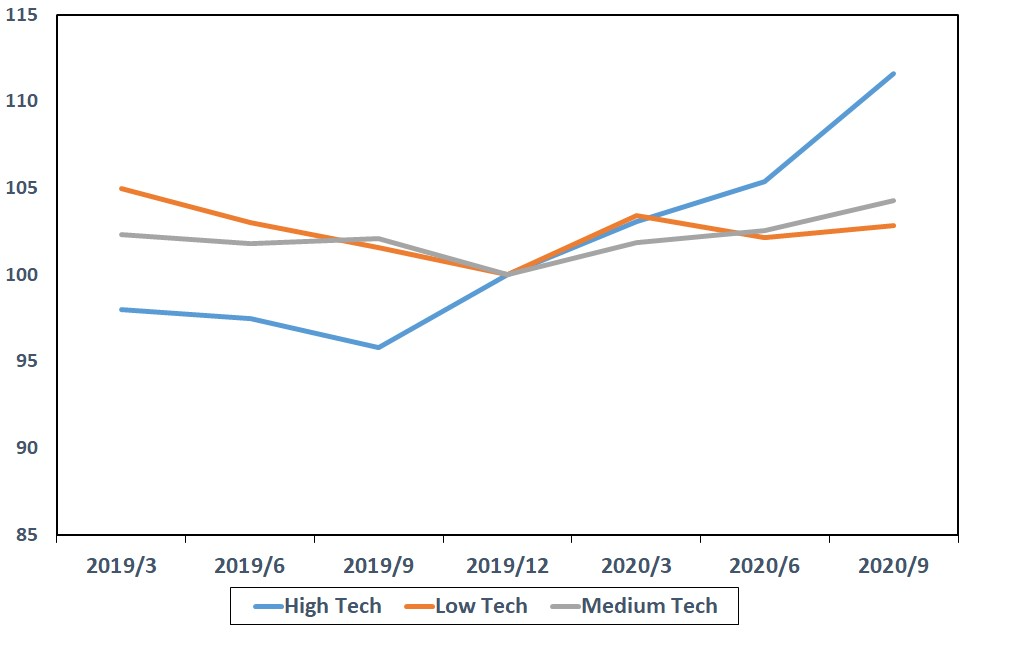

Panel B of Determine 1 displays credit score dynamics in Italy in advance of and just after the pandemic outbreak, dependent on banks’ diploma of digitalisation: because the starting of 2020 credit score drawn by high tech banking companies (i.e. those in the best quartile of the distribution of the IT-to-total costs ratio) enhanced by 11%, 2 times the rate recorded by other loan providers.

Figure 1 IT charges distribution (Panel A) and credit score dynamics across banks’ tech degrees (Panel B)

Panel A

Panel B

Notes: The top graph exhibits the evolution of the 25th percentile, the median, and the 75th percentile of the distribution of the IT-to-full charges ratio in each and every yr. The bottom graph displays lending styles throughout banks with varying degrees of IT adoption. All banking companies in our sample are break up into 3 groups in accordance to their IT-to-overall expenses ratio: low tech if they fall in the base quartile, medium tech if they stand in between the 2nd and 3rd quartile and, higher tech if they are in the best quartile. The total volume of credit score for each every financial institution is normalised to 100 centered on the sum of remarkable credit rating in December 2019.

Credit rating allocation

We also investigate the dynamics of credit and its allocation across NFCs. Making use of a change-in-distinctions identification technique, we obtain that the effect of IT on credit score expansion was more substantial for borrowers most difficult hit by the pandemic. NFCs found in the places of the state most influenced by the pandemic2 experienced a higher boost in lending from higher-tech lenders. We find positive variation in credit score for businesses operating in sectors deemed non-important throughout the lockdown and as a result pressured to shut their bodily areas. Modest and medium-sized enterprises (SMEs) – additional exposed than bigger firms to liquidity shortfalls – have benefited the most from the growth in financial loans fuelled by technologically superior banks.

Electronic as opposed to actual physical channels

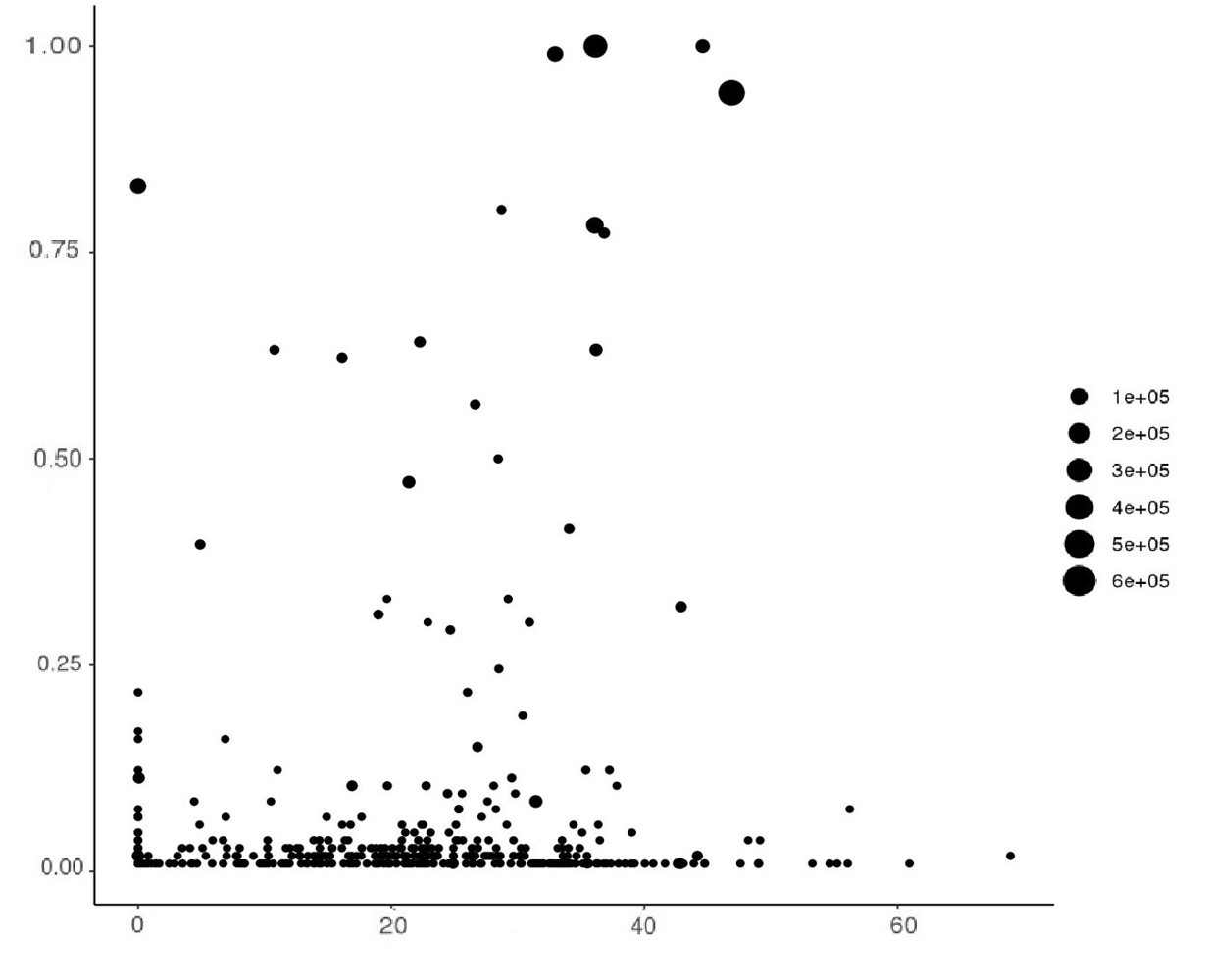

No matter whether technological know-how is minimizing the influence of distance on lending choices is underneath discussion (Petersen and Rajan 2002, Basten and Ongena 2020, Keil and Ongena 2020). In our analysis, we research the position of geographic proximity (among creditors and debtors) in influencing the impact of technological innovation adoption on credit rating through the pandemic. Determine 2 plots the actual physical and digital attain of Italian banking institutions at the eve of the pandemic: at equivalent technological ranges, the dispersion of department diffusion demonstrates a higher heterogeneity in banks’ business versions. In exploring the relative significance of these two proportions, we uncover that banking companies able to provide their consumers by way of both of those traditional and electronic channels showed the best credit expansion from March 2020 onwards in other terms, we present proof that brick-and-mortar areas continue to make any difference, when combined with a sturdy digital existence of the bank.

Determine 2 Distribution of actual physical versus electronic channels

Notes: The horizontal axis reveals the IT costs ratio. The vertical axis provides the percentage of provinces in which the lender has a department. Size of dots correspond to overall assets in thousands and thousands of euro. All computed in 2020.

Conclusion

We drop light-weight on the effects of technological know-how adoption in lending for the duration of the Covid-19 pandemic. Our outcomes recommend that banks with a greater diploma of pre-pandemic IT adoption have granted extra credit to NFCs as the disaster started out to unfold. Bigger electronic capabilities may well have aided financial institutions take care of a larger sized-than-usual range of bank loan purposes, increase workflow as a result of automation, and streamline acceptance processes. We also clearly show that, even below extreme actual physical constraints, prospects nevertheless valued the probability of possessing confront-to-experience interactions with their financial institution. Our assessment paves the way for foreseeable future study on the very long-term effects of digitalisation in banking. As the craze towards digital uptake is in this article to stay, banking institutions require to adapt to transforming buyer choices and foresee shifts in level of competition. Implications for business enterprise design innovation will surely lie in advance.

Authors’ observe: The sights expressed listed here are those of the authors and do not always mirror those people of the Bank of Italy.

References

Basten, C and S Ongena (2020), “Online home loan platforms can make it possible for compact banking institutions to boost their inter-regional diversification”, VoxEU.org, 15 August.

Beccalli, E (2007), “Does IT investment decision make improvements to financial institution efficiency? Proof from Europe”, Journal of Banking & Finance 31(7): 2205-2230.

Branzoli, N, E Rainone and I Supino (2021), “The role of banks’ technological know-how adoption in credit score marketplaces all through the pandemic”, Functioning Paper.

Keil, J and S Ongena (2020), “It’s the end of financial institution branching as we know it (and we sense fantastic)”, Doing work Paper.

Koetter, M and F Noth (2013), “IT use, efficiency, and marketplace electrical power in banking”, Journal of Financial Security 9(4): 695-704.

Kwan, A, C Lin, V Pursianen and M Tai (2021), “Stress screening banks’ digital capabilities: Proof from the covid-19 pandemic”, Operating Paper.

Petersen, M and R Rajan (2002), “Does distance even now make any difference? The data revolution in tiny business lending”, Journal of Finance 57(6): 2533-2570.

Pierri, N and Y Timmer (2020), “Tech in Fin just before FinTech: The great importance of engineering in banking for the duration of a crisis”, VoxEU.org, 9 August.

Endnotes

1 The Regional Financial institution Lending Study (RBLS), performed by the Financial institution of Italy on a yearly basis, will involve a huge sample of Italian financial institutions symbolizing 90% of the deposits of the complete banking method.

2 The severity of the pandemic is tracked working with information on hospitalisations, fatalities, and alterations in household mobility at the province level.

More Stories

Internet Explorer Crashes – Stop Internet Explorer Crashing in Minutes

Jobs for Felons in Information Technology – Find Out If You Are a Fit for These Felon Friendly Jobs

Advantages of Information Technology