[ad_1]

COVID-induced dependency on technologyand initiatives to diversify technology services coupled with growing digitization have been boosting the prospects of the Zacks Technology Services industry. Growth opportunities from robust adoption of the multi-cloud model should offset challenges arising from cyber threats and expenditures related to hiring skillful talent and restructuring initiatives.

IQVIA Holdings Inc. IQV, Blucora, Inc. BCOR and Evoqua Water Technologies Corp. AQUA are some stocks, which are likely to gain from the abovementioned industry trends.

Industry Description

The Zacks Technology Services industry comprises companies that are engaged in manufacturing, developing and designing an array of software support, data processing, computing hardware and communications equipment. These include integrated powertrain technologies, advanced analytics, technology solutions and contract research services, semiconductor packaging and interconnect technologies, collaboration software, specialty printers, and data acquisition and analysis systems. The industry includes consumer as well as business-oriented products and services. It comprises companies with diversified end-markets and customer base. Some industry participants also provide advanced analytics, clinical research services, data storage technology and solutions, and technology-enabled financial solution.

What’s Shaping the Future of the Technology Services Industry?

New Normal Trends Boost Industry Prospects: The industry’s growth is expected to accelerate in the days ahead on the increasing number of remote workers in the wake of the coronavirus-induced work-from-home wave. In this era of digital transformation, enterprises are actively seeking a common ground between on-premise and cloud infrastructures that will enable them to provide flexible and easily adaptable hybrid solutions. Notably, coronavirus-triggered demand for remote working, digital healthcare and online learning solutions has expedited the adoption of digital transformation offerings among enterprises, which bodes well for the industry.

Growing Digitization a Tailwind: Most industry participants are in the process of modernizing their traditional legacy-oriented business processes to keep themselves updated with evolving IT services. The aim is to integrate synergies of emerging technologies including cloud, Internet of Things, Artificial Intelligence and analytics. Moreover, increasing Internet penetration in the emerging markets, particularly across the Asia-Pacific, is a tailwind.

Adoption of the Multi-Cloud Model:Growing uptake of the multi-cloud model to achieve better scalability and attain improved resource utilization is also expanding the scope of the industry participants. Cloud and hardware/software virtual technologies are anticipated to favorably impact the industry. As growth and investment opportunities in developed countries continue to slow down, we believe that emerging economies will play a crucial role in the days ahead.

Growing Cyber Attacks is a Tailwind: The increasing number of cyber-attacks and related security risks are expected to keep the industry’s momentum alive. Government agencies are ideal targets for cyber-attacks, as they are entrusted with sensitive information. Therefore, the growing need for cyber security solutions and services in critical areas like defense, intelligence and civilian agencies of the U.S. government bodes well for the industry players.

Talent Cost Woes: Rising spending on acquiring skilled talent and restructuring initiatives involving modernization of the IT-service infrastructure are causing higher debt levels, R&D, and sales & marketing expenses.

Zacks Industry Rank Indicates Gloomy Prospects

The Zacks Technology Services industry, which is housed within the broader Zacks Business Services sector, currently carries a Zacks Industry Rank #183. This rank places it in the bottom 28% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The sell-side analysts covering the companies in this industry have been decreasing their estimates. Over the past year, the industry’s consensus earnings estimate for the current year has decreased 81.8%.

Despite the cloudy prospects, we present a few stocks that investors can buy or retain in their portfolio. But before that let’s take a look at the industry’s recent stock market performance and its current valuation.

Industry Underperforms Sector and S&P 500

The Zacks Technology Services industry has lagged the broader Zacks Business Services sector as well as the Zacks S&P 500 composite over the past year.

The industry has declined 58% over this period compared with a 43.7% decline of the broader sector. In contrast, the Zacks S&P 500 composite has risen 12.8%.

One-Year Price Performance

Industry’s Current Valuation

On the basis of EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation and amortization), which is commonly used for valuing technology services stocks, the industry is currently trading at 28.16X compared with the S&P 500’s 15.12X and the sector’s 22.77X.

Over the past year, the industry has traded as high as 35.23X, as low as 13.47X and at the median of 20.20X as the charts below show.

EV-to-EBITDA

3 Technology Services Stocks to Keep a Close Eye on

Blucora:This Zacks Rank #1 (Strong Buy) Texas-based company provides technology-enabled financial solutions to consumers, small business owners, tax professionals, financial advisors, and certified public accounting firms in the United States. You can see the complete list of today’s Zacks #1 Rank stocks here.

Blucora has been benefiting from continued solid NPS scores, higher client retention rates, improved marketing effectiveness and ARPU strength driven by its broad set of customer offerings. Operational efficiencies and reduction in expenses are aiding Blucora’s bottom line.

The Zacks Consensus Estimate for Blucora’s 2022 EPS has improved 19.8% in the past 90 days. BCOR stock has gained 16.5% over the past year.

Price & Consensus: BCOR

Evoqua Water Technologies: This Pennsylvania-based Zacks Rank #2 (Buy) company provides water and wastewater treatment systems and technologies, and mobile and emergency water supply solutions and contract services for industrial, commercial, and municipal water treatment markets in the United States and internationally.

Evoqua’s top line has been benefitting from higher volume for products and services across end markets in all regions, coupled with favorable pricing. The company witnessed revenue growth in capital, service and aftermarket categories and across most end markets. However, the bottom line is likely to have been weighed down by increased operating expenses, increased labor and travel costs.

The Zacks Consensus Estimate for Evoqua’s 2022 EPS has improved 14.5% in the past 90 days. AQUA stock has gained 66.2% over the past year.

Price & Consensus: AQUA

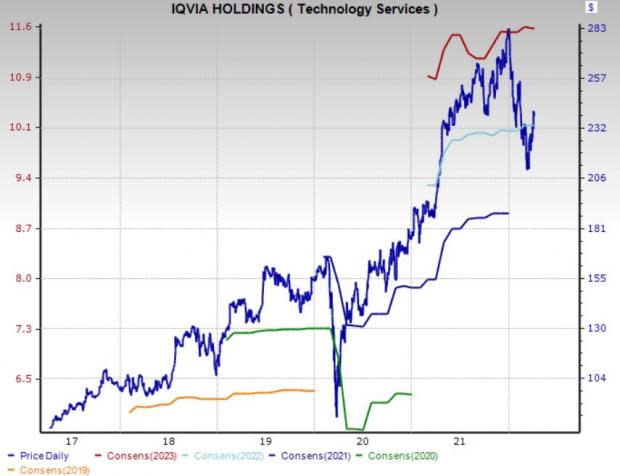

IQVIA Holdings: This Zacks Rank #3 (Hold) North Carolina-based company provides advanced analytics, technology solutions, and contract research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific.

IQVIA Holdings has a strong healthcare-specific global IT infrastructure, analytics-driven clinical development capabilities, a robust real-world solutions ecosystem and a growing set of proprietary clinical and commercial applications that allow it to grow and retain relationships with healthcare stakeholders. With an increasing presence in emerging markets, IQVIA Holdings will likely benefit from growth opportunities in the life sciences industry. Consistent share buybacks boost investor confidence and positively impact earnings per share.

The Zacks Consensus Estimate for IQVIA Holdings’ 2022 EPS has improved 0.6% in the past 90 days. IQV stock has gained 17.1% over the past year.

Price & Consensus: IQV

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

Blucora, Inc. (BCOR) : Free Stock Analysis Report

Evoqua Water Technologies (AQUA) : Free Stock Analysis Report

[ad_2]

Source link

More Stories

Negotiating Technology Contracts

Civilian Applications of GPS Technology

Technology and the Age of Exploration